Owning a boat comes with many joys—open water, adventure, and unforgettable memories. But when accidents happen, filing a boat insurance claim quickly becomes essential to protect your financial investment. Unfortunately, many boat owners make mistakes during the claims process, delaying approval or reducing the payout amount.

Whether the damage comes from a collision, storm, theft, or mechanical failure, knowing how to properly file a claim can make the difference between a smooth process and an overwhelming one. Understanding the pitfalls helps you navigate the process with confidence and ensures your insurance serves you when you need it most.

1. Failing to Document Damage Properly

One of the most common mistakes boat owners make is not gathering enough evidence.

- Take clear photos and videos from multiple angles

- Record the date, time, and circumstances of the incident

- Preserve receipts for equipment and repairs

Your insurer relies heavily on visual documentation—especially if an adjuster cannot inspect the boat immediately.

2. Waiting Too Long to Report the Incident

Many policies have strict deadlines. Waiting too long may lead to:

- Reduced benefits

- Denied claims

- Suspicion of fraud

File a claim as soon as possible—even if you’re unsure about the extent of damage.

3. Not Reviewing the Policy First

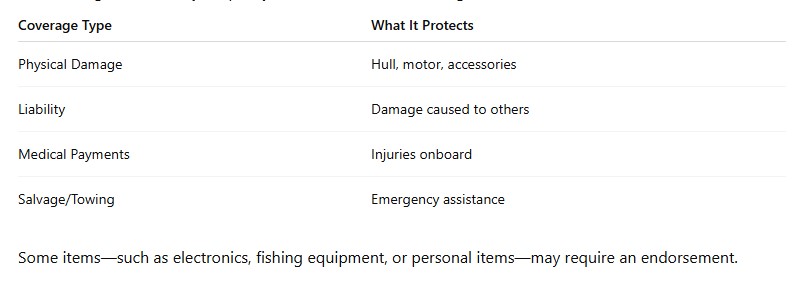

Before filing, know what your policy includes. Common coverage areas include:

4. Making Unauthorized Repairs Before Inspection

It’s tempting to immediately fix your boat, especially if the damage affects safety or usability. However, unless repairs are critical to prevent further damage, wait until:

- The insurer approves the scope

- An adjuster completes an inspection

Temporary fixes are fine, but permanent repairs should never be done without approval.

5. Not Providing Accurate or Complete Information

Honesty is essential in insurance claims. Providing incomplete or misleading information—intentionally or not—can track as a red flag and result in:

- Delayed processing

- Additional verification or investigation

- Claim denial

Be detailed, factual, and consistent.

6. Forgetting to Track Expenses

Boat claims often involve multiple costs such as:

- Storage and hauling

- Estimates and inspections

- Temporary equipment purchases

Keep all receipts—these may be reimbursable depending on policy terms.

7. Not Following Up

Insurance claims require communication. If an adjuster requests additional documents, respond promptly. Consistent follow-up helps ensure your claim moves through the system without unnecessary delays.

Local Note

If you’re filing a boat insurance claim in Reno, NV, working with a local agent familiar with regional boating conditions—such as Lake Tahoe, Pyramid Lake, or Sparks Marina—can help streamline the claims process and ensure you have the right documentation based on local regulations and common risks.

How to Improve Your Chance of a Smooth Claim

- Review your policy annually

- Keep maintenance records

- Install safety and security equipment

- Create a pre-season inspection checklist

These steps demonstrate responsible ownership and may support your claim.

Conclusion

Filing a boat insurance claim doesn’t have to be stressful. By avoiding common mistakes—like delaying reporting, neglecting documentation, or making unapproved repairs—you can protect your investment and ensure a faster, more favorable claims process.

Being prepared and proactive today can save you time, frustration, and money when the unexpected happens on the water.

At Capital Insurance Service, we are committed to offering our clients a wide range of comprehensive and affordable insurance policies. We go above and beyond to ensure that we meet your unique needs with tailored solutions. To find out more about how we can assist you, please reach out to our agency at 775-301-9099 or CLICK HERE to request a free, no-obligation quote.

Disclaimer: The content provided in this blog is for informational purposes only and should not be considered professional advice. For personalized guidance, it is important to consult with a qualified insurance agent or professional. They can offer expert advice tailored to your individual situation and help you make well-informed decisions about your insurance coverage.