Buying a motorcycle is exciting—whether it’s brand new, pre-owned, or a project bike you’ve been wanting to restore. But before you hit the road, there are a few legal and safety steps to take. One of the most common questions new motorcycle owners ask is: “Can I insure a motorcycle that isn’t registered yet?”

The short answer is yes—you can typically insure a motorcycle before it’s registered. In fact, in many cases, you’ll need insurance first in order to register the bike.

This guide walks you through how it works, why insurance may be required upfront, and what to consider when insuring an unregistered motorcycle.

Why You May Need Insurance Before Registration

Many states require proof of insurance before issuing a registration or license plate. This ensures that once the bike is on the road, it meets minimum liability coverage requirements.

Common Reasons to Insure Before Registering

- You just purchased your motorcycle and haven’t registered it yet

- You bought the bike from a private seller (no dealership paperwork assistance)

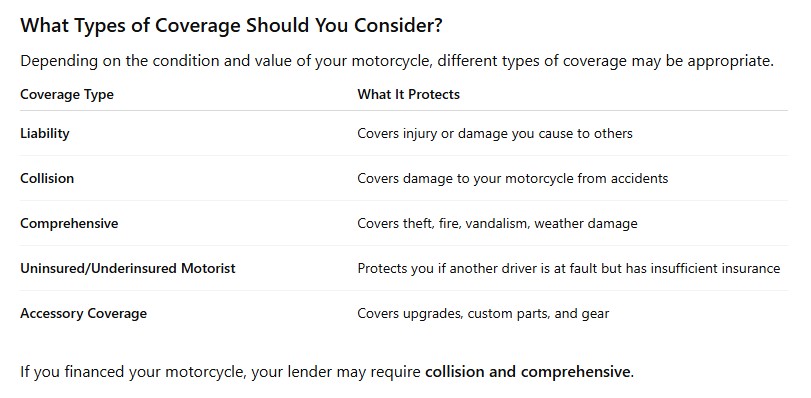

- You plan to finance the motorcycle (lenders often require full coverage)

- You are restoring or repairing the bike but want financial protection now

In most cases, you will need at least liability insurance to get the motorcycle registered.

How to Insure a Motorcycle Before Registration

Insuring an unregistered motorcycle is similar to insuring any other vehicle, but you’ll need specific identifying information.

Information Your Insurer May Need

- VIN (Vehicle Identification Number)

- Year, make, and model of the motorcycle

- Your driver’s license

- Your contact and address information

Your insurer does not need your license plate number to start a policy—so insurance can begin before registration is completed.

Special Considerations for Project or Non-Running Motorcycles

If your new bike is not road-ready, you still may want insurance—especially if it has significant value.

Why Insure a Non-Running Motorcycle?

- Protection from theft while stored

- Coverage for fire damage or accidental damage

- Peace of mind during restoration work

In this case, you may choose comprehensive-only coverage until the bike is ready to ride.

Local Insight: Reno, NV

In Reno, NV, you’ll need to show proof of insurance before you can complete motorcycle registration with the Nevada DMV. Because riding is popular in the region’s open-road and scenic routes, ensuring your bike is insured before hitting the road helps you stay compliant and protected, no matter the season.

Steps to Register After Insuring

Once your motorcycle is insured, registration is straightforward:

1.Visit your local DMV (appointments often recommended).

2.Bring:

- Proof of insurance

- Title or bill of sale

- VIN inspection certificate (if required)

- Fees for registration and plates

3.Receive plates and registration.

You’re now legally ready to ride.

Tips to Avoid Delays

- Verify the motorcycle’s VIN before purchase.

- Ask your insurance agent what documents will be needed.

- Don’t ride until registration is completed (you could face fines).

Conclusion

Yes—you can insure a motorcycle that isn’t registered yet. In fact, insurance is often the first step before registration can happen. Whether your bike is brand new, used, or still undergoing restoration, getting the right insurance ensures you are financially protected and legally prepared when the time comes to ride.

Taking care of insurance early helps your motorcycle journey start smoothly—from purchase to pavement.

At Capital Insurance Service, we are committed to offering our clients a wide range of comprehensive and affordable insurance policies. We go above and beyond to ensure that we meet your unique needs with tailored solutions. To find out more about how we can assist you, please reach out to our agency at 775-301-9099 or CLICK HERE to request a free, no-obligation quote.

Disclaimer: The content provided in this blog is for informational purposes only and should not be considered professional advice. For personalized guidance, it is important to consult with a qualified insurance agent or professional. They can offer expert advice tailored to your individual situation and help you make well-informed decisions about your insurance coverage.