Needing a tow often comes at an already stressful moment—whether your car broke down, you were involved in a collision, or your vehicle needed to be transported for repairs. But what happens if your car gets damaged during the towing process itself? While towing companies are expected to handle vehicles safely, accidents and mishandling do happen. Understanding your rights, how insurance applies, and the steps to take can help you protect your vehicle and your wallet.

This guide explains what to do if your car is damaged while being towed and how to avoid headaches throughout the claims process.

How Damage Can Occur During Towing

Even professional tow truck operators can make mistakes. Damage may happen during loading, transport, or unloading.

Common Types of Towing-Related Damage

- Scratched or dented exterior panels

- Bent or cracked bumpers

- Broken suspension components

- Damage to tires or rims

- Transmission damage (especially when improper towing methods are used)

Some cars—particularly AWD, 4WD, or low-clearance vehicles—require specific towing equipment. If the wrong method is used, costly mechanical damage may occur.

Who Is Responsible for the Damage?

1. The Towing Company

Most towing companies carry liability insurance that covers damage caused by their equipment or operator error. If the tow truck driver improperly hooks, loads, or transports your vehicle, the towing company is likely responsible.

2. Your Auto Insurance

If the towing company denies fault, your auto insurance may cover the damage if you carry:

- Collision coverage

- Comprehensive coverage

Your insurer may then pursue reimbursement from the towing company (a process called subrogation).

3. Another Party

If your car was towed due to being illegally parked or impounded, liability may depend on:

- Local laws

- Towing procedures

- Your vehicle’s condition before the tow

Documentation is key in these situations.

What to Do Immediately if Damage Occurs

Step-by-Step Guide

1.Document the damage

- Take clear photos and videos from multiple angles.

- Note any debris, skid marks, or equipment involved.

2.Request the tow report

Tow companies often record vehicle condition upon pickup.

3.Get witness statements (if applicable)

If others saw the damage occur, record their contact details.

4.Contact the towing company

Calmly explain the damage and request their insurance information.

5.Notify your auto insurance provider

Even if the tow company is responsible, starting the process early helps.

How Claims Are Handled

When the Towing Company Accepts Responsibility

- Their insurer will assess the damage.

- Repairs are typically made at a recommended auto shop.

- You should not owe a deductible.

When You File Through Your Insurance

- You may need to pay your deductible upfront.

- Your insurer may later recover the cost and refund your deductible.

When Fault Is Disputed

- Mediation or small claims court may be required in severe cases.

Local Insight: Reno, NV

In Reno, NV, rapidly changing weather—especially snow and ice—can lead to increased vehicle breakdowns and towing frequency. Because of this, it’s especially important to work with licensed and insured towing companies and to confirm that they have experience handling your vehicle type.

How to Avoid Towing Damage in the Future

- Request flatbed towing when appropriate.

- Use reputable towing companies with strong customer reviews.

- Ask the tow operator to confirm vehicle-specific towing precautions.

- Remove valuables before towing.

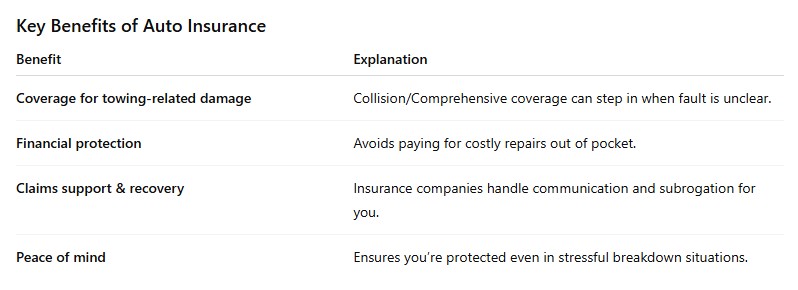

Why It’s Important to Have Auto Insurance

Even when the towing company is responsible, having strong auto insurance helps you stay protected from unexpected repair costs and delays.

Who Auto Insurance Best Serves

- Daily commuters

- Drivers of newer or high-value vehicles

- Anyone who may require towing or roadside assistanc

Tip: Consider adding Roadside Assistance Coverage to simplify the towing process and reduce out-of-pocket costs.

Conclusion

Damage during towing is frustrating—but knowing your rights and next steps helps you manage the situation with confidence. Be sure to document everything, communicate with the towing company promptly, and involve your insurance provider early.

With the right auto insurance and a careful approach to selecting towing services, you can keep stress and expenses to a minimum and get your vehicle back on the road faster.

At Capital Insurance Service, we are committed to offering our clients a wide range of comprehensive and affordable insurance policies. We go above and beyond to ensure that we meet your unique needs with tailored solutions. To find out more about how we can assist you, please reach out to our agency at 775-301-9099 or CLICK HERE to request a free, no-obligation quote.

Disclaimer: The content provided in this blog is for informational purposes only and should not be considered professional advice. For personalized guidance, it is important to consult with a qualified insurance agent or professional. They can offer expert advice tailored to your individual situation and help you make well-informed decisions about your insurance coverage.