Life is unpredictable. Being prepared for the worst is the best way to take care of our loved ones when we are gone. Life insurance provides your family with financial support to take care of any end-of-life expenses such as funeral cost. So, what exactly is life insurance? It is a legally binding contract between the insured and the insurance company. The insurance companies will give the designated beneficiaries what is known as a ‘death benefit’ upon the insured passing. You may need a medical exam prior to getting your policy depending on which life insurance policy suites you best.

Here are 3 reasons why you should get your own life insurance policy:

- If the bread winner of the family passes away, their family and loved ones are stuck in emotional and uncomfortable positions having to make hard decisions, and make them quickly. A life insurance policy will allow them more time and money to adjust to their new life.

- When the person is in debt it can financially effect the family member and life insurance but will help whatever debt is left to be paid and funeral expenses can also be covered.

- Preparing for the unexpected. Things happen and those things can be unfortunate. Having life insurance policy can offer you peace of mind that will your loved ones will not have to worry about covering end of life expenses.

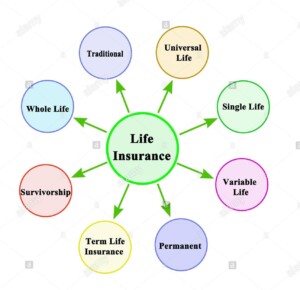

Life Insurance Policy Options

There are 7 different types of life insurance you can choose from. The kind you decide to get will depend on a verity of things, including: how long you need the policy for, your life style, and what payment options is best for you. Here are the differences between each policy type to help you make your decision.

- Term life insurance:

- Last for a specific number of years, ranging between 5-30 years

- Coverage amounts will vary but it can go up to millions

- Often the most affordable options

- If you outlive policy there is no payout

- Whole Life Insurance

- Last until your death

- Guaranteed rate of return on the policies cash vale

- Covers you for the entire life and builds cash value

- Typically, more expensive

- Universal Life Insurance—2 types

- Guaranteed: Death benefit is guaranteed

- You can choose the age that death benefit will be guaranteed

- Affordable and premium does not change

- A missed payments can result an loosing the policy and walking away with nothing

- Indexed: links policies cash value to stock market

- Gaines are determined by a formula outlined in your policy

- Cash value is accessible and grows over time

- Your cash value gains will be subject to a cap

- Variable life insurance

- Tied to investment accounts Like bonds and mutual funds

- There is potential for gains if your investment choices do well

- You can take partial withdrawals or borrow against it

- Premiums are fixed and death benefits are guaranteed

- Requires you to be hands on and managing your policy

- Simplified Life Insurance

- Don’t require you to take a medical exam

- Maybe asked a few health questions and may be rejected depending on your answers

- Instant approval life insurance policies will use quick online questioners and algorithms to speed up the application process

- Guaranteed Life Insurance

- No medical exams or health questions

- If within the eligible age range ( between 40 to 85) you can not be turned down

- Expensive way to buy life insurance

- Coverage amount are very low

- Group Life Insurance

- Offered by employers as part of the company’s benefits

- Premiums are based on group as a whole

- Employers will generally offer basic coverage for free

- If you need more coverage, you have the option to purchase a supplemental life insurance policy

Capital Insurance Service offers a variety of health insurance options. Speak to our life insurance experts today to see which policy is best for you.

Reno: 775-853-3388 Carson City: 775-883-4433